What am I offering?

I have spent the last 3 years building a long/short trading strategy on ES and NQ futures that works on daily candles. Primarily using Pine Script on TradingView to backtest, my regression model uses a combination of

Economic data from FRED (https://fred.stlouisfed.org/)

Simple moving averages (20d, 50d, 150d, 200d)

Momentum Oscillators (i.e. Relative Strength Index)

to create a fair value index against ES and NQ futures and makes a determination on daily time frames whether or not to stay, close or enter a trade. In 2024, my strategy made 9 trades total so a big chunk of time spent by my model is staying in a trade for a long period of time.

I’ve worked a lot from my base model to add points in time when it would be appropriate to scale and re-enter trades within the model’s band of overbought and oversold. Overbought and oversold criteria may only trigger 3-5 times a year, so this allows me to try and hold risk during times of outsized returns as much as possible.

I work on the back-adjusted ES / NQ futures data on TradingView which means not accounting for contract roll-over and other determinants. Rolling over is an art, as is setting stops on trades. If done well, I think my model can offer great value for holding risk over long periods of time.

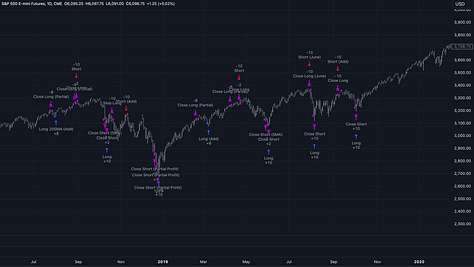

ES Strategy Backtest

The backtest runs from October 2011 when I find that conditions are met for the first time with all data also available for my regression model. I start with about $30,000 and use today’s margin requirements back with a pyramiding scheme to add onto existing positions. I stop myself at 10 contracts, which is the maximum amount some retail brokers will permit a retail trader to take on.

NQ Strategy Backtest

I do the same with NQ.

As a part of this Substack I will be putting in

Weekly posts on how the strategy is looking and what are its current positions (every Saturday)

Posts whenever the strategy adds to, closes (partially or full), or enters positions. This could be twice in 3 weeks or once in 4 months as you can see from the backtest.

By no means do I think this strategy is a finished product and I spend a lot of time every week trying different scenarios, different combinations / parameters and test them out on set periods of time - picking the best based on PnL and drawdown metrics. As a result, I will also be adding strategy updates or improvements I make to this Substack.

For example, if I add a condition to my strategy or update my model that improves its backtest, I will post about that as well. Sometimes this doesn’t change its current position, but other times it may suggest closing, adding to or entering a different position than what it currently is in. I will make a detailed post highlighting this as well if this were to occur.